Why Businesses Choose GEN AI for Lending

GEN AI transforms lending by automating property ownership verification, tax assessment, and affordability analysis with intelligent precision. It eliminates delays caused by manual verification, reduces fraud risks, and accelerates approvals through automation. Its enterprise-ready, globally adaptable design ensures compliance with local regulations, enhances transparency, and lowers operational costs—making it a trusted solution for financial institutions worldwide.

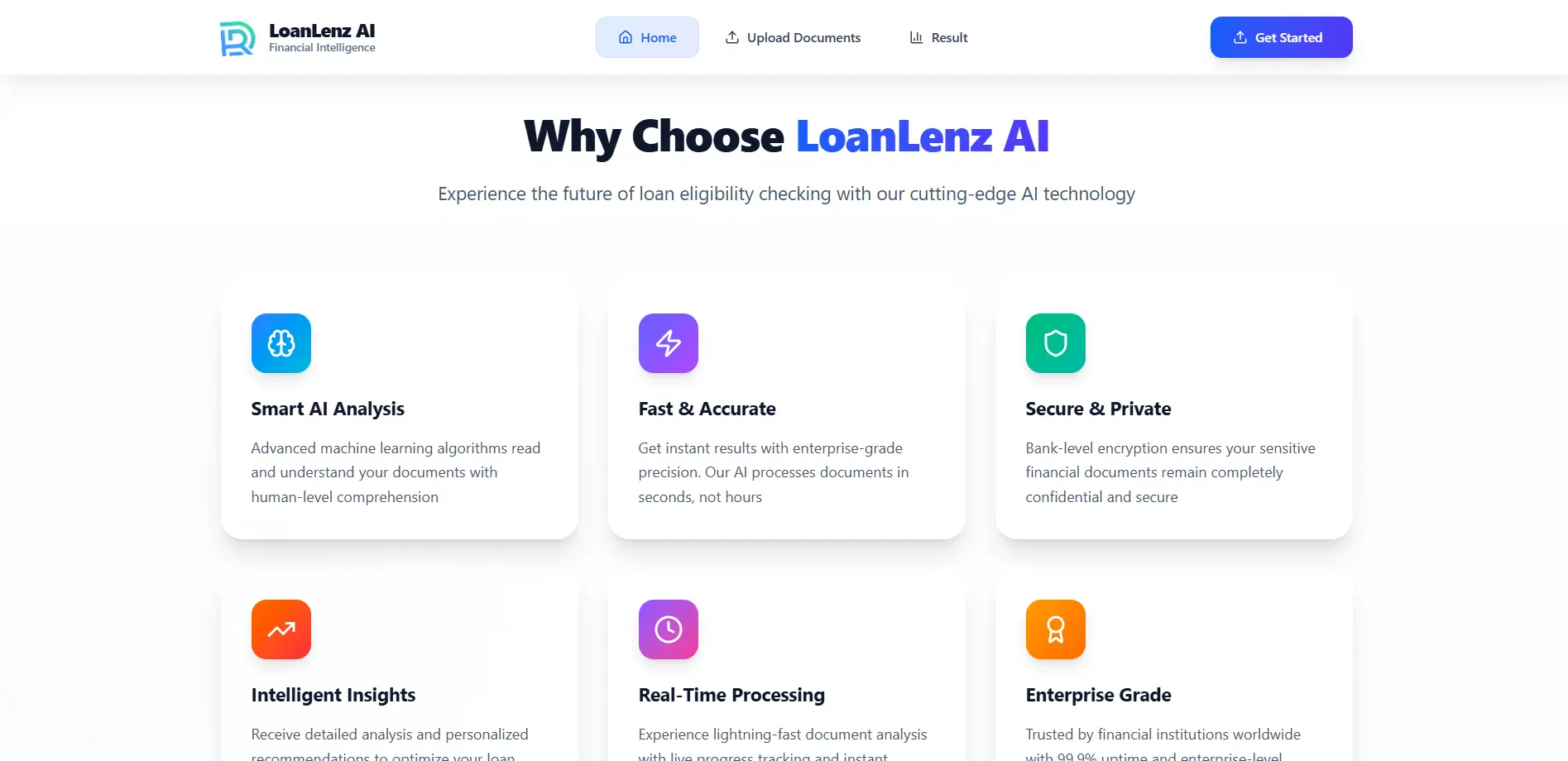

LoanLenz AI is one of the developed enterprise-grade solutions designed to modernize lending operations into a seamless, AI-driven ecosystem that delivers actionable insights. It is built for banks, NBFCs, housing finance companies, and government-backed financial entities to achieve faster loan processing, improved risk management, and customer trust at scale.

By leveraging GenAI, the platform automates document verification, performs real-time affordability checks, and provides compliance-ready summaries—shifting lending from slow, manual processes to fast, transparent, AI-powered decisioning.

Key Capabilities

This AI-powered lending solution delivers automated property and tax verification, intelligent affordability analysis, and compliance-ready reporting for streamlined adoption. Its adaptable architecture ensures scalability across countries and financial regulations. The system provides a centralized interface to track application history, risk insights, and operational efficiency—enabling organizations to reduce costs, prevent fraud, and approve loans with confidence at enterprise scale.

Best Fit

The LoanLenz AI platform is ideally suited for banks, NBFCs, mortgage lenders, fintechs, and regulatory agencies. It helps organizations modernize loan assessment, extend lending services across geographies, and leverage AI-driven insights to strengthen compliance, reduce turnaround time, and build sustainable growth. Reinvent lending with enterprise-grade AI intelligence.

LoanLenz AI is one of the developed enterprise-grade solutions designed to modernize lending operations into a seamless, AI-driven ecosystem that delivers actionable insights. It is built for banks, NBFCs, housing finance companies, and government-backed financial entities to achieve faster loan processing, improved risk management, and customer trust at scale.

By leveraging GenAI, the platform automates document verification, performs real-time affordability checks, and provides compliance-ready summaries—shifting lending from slow, manual processes to fast, transparent, AI-powered decisioning.

Key Capabilities

This AI-powered lending solution delivers automated property and tax verification, intelligent affordability analysis, and compliance-ready reporting for streamlined adoption. Its adaptable architecture ensures scalability across countries and financial regulations. The system provides a centralized interface to track application history, risk insights, and operational efficiency—enabling organizations to reduce costs, prevent fraud, and approve loans with confidence at enterprise scale.

Best Fit

The LoanLenz AI platform is ideally suited for banks, NBFCs, mortgage lenders, fintechs, and regulatory agencies. It helps organizations modernize loan assessment, extend lending services across geographies, and leverage AI-driven insights to strengthen compliance, reduce turnaround time, and build sustainable growth. Reinvent lending with enterprise-grade AI intelligence.